- #Free home inventory software windows how to#

- #Free home inventory software windows serial#

- #Free home inventory software windows full#

The main advantage of this method is that it’s easy to get started right away.

#Free home inventory software windows how to#

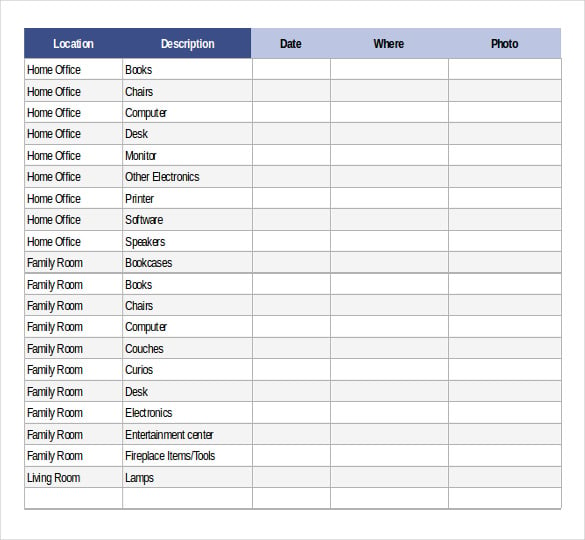

For others, you can include notes on your list about how to replace them, such as “Contact State Department to replace lost passport.” That way, if there’s ever a fire or other disaster, you’ll be able to remember which documents you need to replace.įor some documents, such as bank records, you can store a backup copy online or in another location. One item that’s worth listing, even if it doesn’t have much monetary value, is important documentation, such as financial and legal records. Pricey items like these often need separate insurance coverage, so let your insurance company know about them before you have to file a claim, and make sure you have enough insurance to cover them. If you own any particularly valuable items, such as artwork and fine jewelry, create a separate section on the inventory list for these. In general, the more you paid for an item, the more documentation you should provide for it. If you have any documents that show an item’s value, such as receipts, purchase contracts, or appraisals, attach them to the home inventory.

Depending on which type of policy you have, you should list either the cash value or the replacement value. Along with the description of each item, include an estimate of how much it’s worth. However, if you have clothing items that are particularly valuable, such as a couture gown, list those separately.

For small items like clothing and books, you don’t have to count each item individually – just list the number of items you own in a category, such as shoes or pants.

#Free home inventory software windows serial#

For appliances (especially major appliances, such as refrigerators and and washers and dryers) and electronics, include the make, model, and serial number, which you can usually find on the back or bottom. As you list each item on your home inventory, add a description with details such as where and when you bought it and what condition it’s in. The more documentation you can provide with your home inventory, the better. In fact, the Insurance Information Institute (III) recommends making a home inventory even before you sign up for a home insurance policy to figure out just how much coverage you need.

#Free home inventory software windows full#

By making a list of your belongings, with photos to back it up, you can show exactly what you owned before the claim and how much it was worth. Keeping an up-to-date home inventory makes it easier to get an insurance claim settled quickly and make sure you get the full amount that’s due to you. That’s where your home inventory comes in. So you have to provide a list of the items you’ve lost – something that is hard to do from memory. That’s because a disaster doesn’t always destroy everything inside your home, and the company doesn’t want to reimburse you for anything that you still have. However, no matter which type of coverage you have, the company doesn’t simply write you a check for this amount when you file a claim. For $79 (or just $1.52 per week), join more than 1 million members and don't miss their upcoming stock picks. Motley Fool Stock Advisor recommendations have an average return of 618%. Others cover only the actual cash value, the price that your belongings would fetch if you sold them in their current condition. Some policies cover the replacement value of your goods, or the amount it would cost to buy new items to replace the ones you’ve lost. When you buy a home insurance policy, it lists two numbers for property coverage: one for the value of the dwelling itself, and one for “personal property.” This second number is the maximum amount you can claim for belongings that are destroyed in a covered disaster, such as a fire or mudslide. A list like this is called a home inventory, and it’s the best friend you can have when you need to file a home insurance claim. But fortunately, you don’t have to. Instead, you can write out your list ahead of time, while all your possessions are intact and right in front of you.

Unless you have a mind like a computer, the answer is probably no. The company tells you that in order to process the claim, they need a complete list of everything in the home you’ve lost with details, such as the age and estimated value of each item. Would you be able to come up with that list from memory? Once you recover from your shock, you call your home insurance company to file a claim. You and your family escape unharmed, but by the time the fire is extinguished, there’s hardly anything left of the house or its contents. Imagine that one night your house catches fire.

0 kommentar(er)

0 kommentar(er)